Duluth Branch

Grand Opening

Promotion

Promotions are offered only at Hanmi Bank Duluth branch for a limited time.

We Are Excited to Support the Communities in Atlanta, Georgia

To celebrate the launch of our new branch in Duluth, Georgia, we invite you to come in and take advantage of our limited-time offers

Personal Checking Offer

Enjoy $300 when you open a Hanmi personal checking account with qualifying transactions

See Details

Simple Steps to Qualify for $300 Cash Incentive1

- Maintain $10,000 average daily balance for first 3 full months

- Conduct minimum of 5 debit card transaction or 1 ACH transaction during each of first 3 full months

- Enroll in eStatement within 30 days after account opening date

Additional Benefits for the Fisrt 100 New Personal Checking Accounts

1Personal Checking Offer – $300 Cash Incentive: To be eligible for the offers, you must be one of the first 100 customers who open a personal checking account at the Duluth Branch between March 3, 2025 to May 30, 2025. Offers are valid for any new personal checking account customer. Personal checking account must be opened with new money. A new checking account customer is defined as a customer who does not have an existing personal or joint account relationship with Hanmi Bank within the past 60 days. New money is defined as funds that are not held at Hanmi bank. Funds withdrawn from another Hanmi Bank account do not count as new money. Only one (1) eligible account per customer (SSN/TIN). Eligibility evaluation period is three (3) full months after account is opened. $300 cash incentive will be credited to the account within sixty (60) days after end of evaluation period. Cash incentive will be considered interest and 1099-INT (1042-S, if applicable) will be issued. This offer cannot be combined with any other personal checking offer. Account must remain open and have a 3-month average daily balance of $10,000 or higher for the 1st three full months to qualify for the cash incentive. 3-month average balance is calculated by dividing the sum of the daily balance (for the 1st three full months), by the total number of days in those three months.

2Free Basic Checkbook: To be eligible, you must be one of the first 100 customers who open a personal checking account at the Duluth Branch between March 3, 2025 to May 30, 2025.

3Wire fee waiver voucher: To be eligible, you must be one of the first 100 customers who open a personal checking account at the Duluth Branch between March 3, 2025 to May 30, 2025. Wire fee waiver voucher is valued at $30 each and is valid for outgoing, domestic and international wire transfers in U.S. dollars. Voucher is valid for use in person at Hanmi Bank Duluth branch location only. Voucher is non-transferable and may not be altered, copied, or duplicated. Voucher cannot be redeemed for cash and is valid for use until September 30, 2025.

Business Checking Offer

Earn up to 200,000 points4 when you open a Hanmi business checking account with qualifying transactions. That’s worth up to $2,000 in cash value!6

See Details

Open a New Business Checking Account Today and

- Earn 25,000 bonus points4 when you maintain at least $15,000 average daily balance for the first 3 full months5

- Earn 100,000 bonus points4 when you maintain at least $50,000 average daily balance for the first 3 full months5

- Earn 200,000 bonus points4 when you maintain at least $100,000 average daily balance for the first 3 full months5

How to Earn Your Points7

- Open a New Checking Account: Visit any Hanmi Bank branch to open a business checking account.4

- Meet Eligibility Criteria: You must order, activate, and enroll your debit card in uChoose Rewards® within 30 days of account opening at uchooserewards.com4

- Maintain Balance: Keep the required average daily balance to earn qualified bonus points for the first three full months after opening the account.5

- Earn Points: Points will be credited to your uChoose Rewards® account within 30 calendar days of meeting all requirements.6

How to Use Your Points7

- To activate the redeem function for your business uChoose Rewards® account, please contact your branch or our Call Center at 855-773-8778. Please note: Activation of the redeem function takes 1 business day to complete. Following the 1 business day activation period, you will be able to start redeeming your points.

- Visit uchooserewards.com and follow redemption instructions.

- You can redeem your points for cash back, gift cards, and more.

Additional benefit for qualified business checking accounts

Free Initial Checkbook

Get a complientary checkbook up to $150 in value when you open an account with a minimum opening deposit of $10,000. This offer is available to the first 100 customers between March 3, 2025 and June 30,2025.

This offer is valid from March 3, 2025 to June 30, 2025. The offer is subject to change and may be discontinued at any time without notice.

4Business Checking Offer: Offer is valid for new business checking customers; new business checking customer is defined as a customer who has not had an existing business checking relationship with Hanmi within the past 60 days. One eligible account per TIN. You must order and activate your debit card. Enrollment in uChoose Rewards is required within 30 days after the account opening date to qualify for the bonus points. You must remain enrolled in uChoose Rewards for point crediting on the payout date.

5Account must remain open and have a 3-month average daily balance of either $15,000, $50,000 or $100,000 or higher for the 1st three full months to qualify for the bonus points. 3-month average balance is calculated by dividing the sum of the daily balance (for the 1st three full months), by the total number of days in those three months.

6Points will be credited within 30 days after the 1st three full months and account must remain open at time of payout. Points will expire 3 years from the month in which they were credited.

7uChoose Rewards® is not an affiliate of Hanmi Bank. All names and logos are registered trademarks of their respective owners. Cash value of 100 uChoose Rewards® points is $1.

Safe Deposit Box Offer

Enjoy a one-year fee waiver for a 3×5 size Safe Deposit Box!8

See Details

Be among the first 80 customers to open a personal or business checking account with a minimum opening balance of $15,000 or open a money market or savings account with $200,000 minimum opening balance to qualify for this exclusive offer.

Hanmi Safe Deposit Box

- Top-Tier Security

Rest assured that your valuables are protected in a highly secure, state-of-the-art facility, equipped with advanced surveillance and security systems. - Easy Access

With convenient hours and easy access, you can retrieve your items whenever necessary during business hours. - Privacy and Confidentiality

We prioritize your privacy, offering a discreet and secure space, ensuring the highest standards of client confidentiality. - Professional Staff

Our experienced and friendly staff are trained to assist you with any needs, providing top-notch service and support.

8Safe Deposit Box Offer: To be eligible, you must open a personal or business checking account with a minimum opening deposit of $15,000 or higher or open a personal or business money market or savings account with a minimum opening deposit of $200,000 or more between March 3, 2025 and May 30, 2025. Safe Deposit Box must be opened within 30 days after a checking, money market or savings account is opened, and is limited to the first 80 new checking, money market or savings customers. First 80 customers is defined as the combined total of business and personal checking, money market or savings customers meeting the minimum opening balance requirement and opening a Safe Deposit Box. One year rental fee waiver is offered for 3×5 size safe deposit box. Only one (1) eligible account per customer (SSN/TIN).

Visit us to take the advantage of these special promotions!

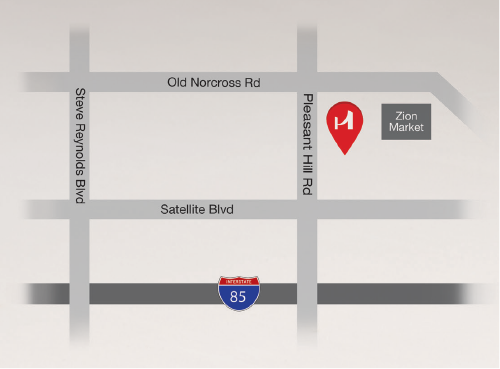

Hanmi Bank Duluth Branch

2330 Pleasant Hill Road, Suite 100

Duluth, GA 30096

(770) 341-8850

BUSINESS HOURS

- Monday – Friday

- 9:00 A.M. to 5:00 P.M.

About Hanmi Bank

Established by Korean immigrants as the first Korean American bank in 1982, Hanmi Bank’s founding principles were to help guide and support fellow Korean American immigrants in fulfilling their dreams. Hanmi now serves multi-ethnic communities through a network of 32 branches and 5 loan production offices across 9 states, coast-to-coast. Our mission is to provide quality financial services that support every American’s dream, and we pride ourselves on being experts in business banking.

$7.68 billion

Total Assets

$6.25 billion

Total Lending

$6.43 billion

Total Deposits

All figures as of 12/31/2024

Bank on Your Dream

Our mission is to provide quality financial services to support your American dream. We pride ourselves on being experts in business banking. As a trusted partner to small businesses and an advocate of strong local communities, we have dedicated ourselves to helping small businesses grow and thrive for nearly four decades. Hanmi Bank offers a wide array of products and services to fit your needs, including SBA Lending, Commercial Real Estate Lending, Equipment Leasing, Specialty Lending, Treasury Management Services and much more. From 24/7 mobile business banking to personalized, relationship-based service, Hanmi is with you every step of the way.

We’re Here to Help

You’ve got a team of experts on your side. Whether you have a simple question or need a comprehensive banking solution, we’re here for you.

Visit a local Hanmi Bank branch near you

Find addresses, phone numbers, and business hours for your Hanmi Bank branches and ATMs. We’re here for face-to-face support in person.

Call us at

855-773-8778

Help is just a phone call away. Our Customer Call Center is open Monday ~ Friday, 7:00 AM to 6:00 PM PT for your personal and business banking needs.